child tax credit december 2021 payment

Families that receive too much may have to pay the difference back depending on their income. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C.

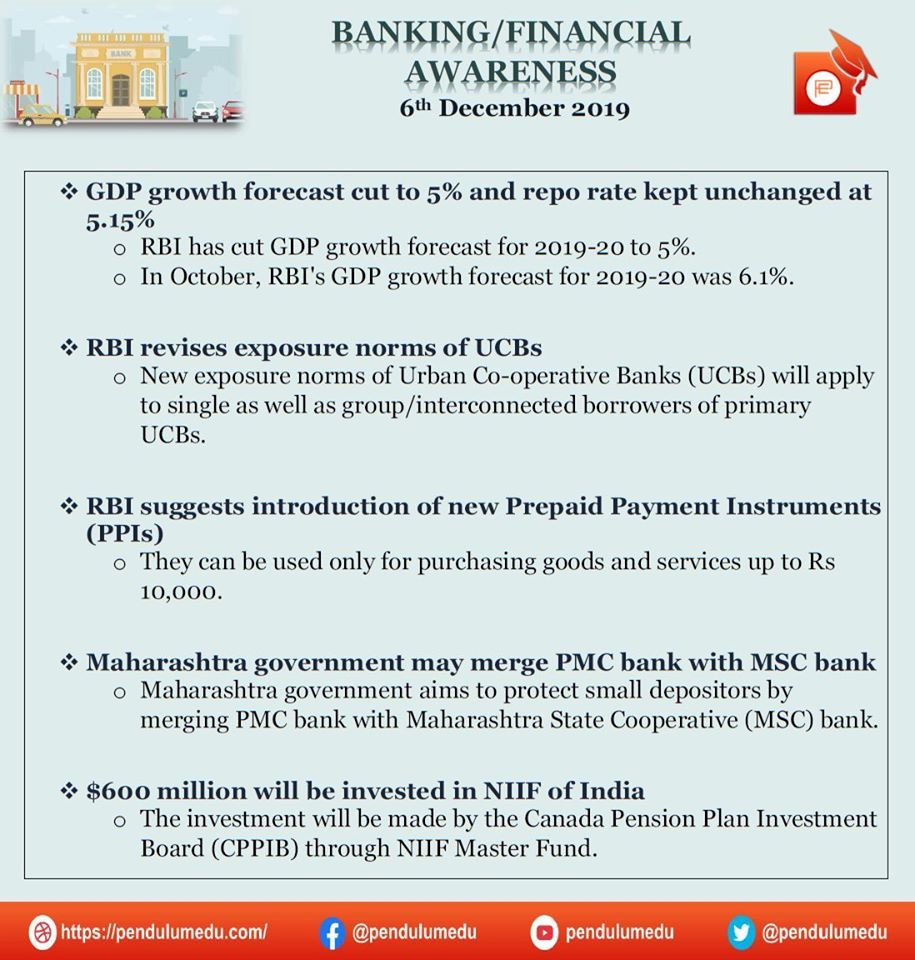

Daily Banking Awareness 06 December 2019 Awareness Financial Banking

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

. Understand how the 2021 Child Tax Credit works. The 2021 advance monthly child tax credit payments started automatically in July. This means that the total advance payment amount will be made in one December payment.

The American Rescue Plan also authorized advance monthly payments of the Child Tax Credit through December 2021. Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return filed in 2022. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

However president joe biden s administration is crafting a bill that would return the payment in february with a back payment issued for the missed january installment. The IRS began issuing child tax credit payments on July 15 2021. Taxpayers could use a designated IRS online tool referred to as the Child Tax Credit Update Portal to opt out of advance payments.

Even though child tax credit payments are scheduled to arrive. Eligible families who did not opt out of the monthly. This payment is an advance and most families will receive half of their credit.

David rothkopf djrothkopf december 19 2021. 3600 for children ages 5 and under at the end of 2021. When you file your taxes for 2021 in 2022 you will receive the other half of the benefit.

President Biden has proposed extending the enhanced Child Tax Credit including monthly payments for at least 2022. This is what it looks like PDF. The taxpayer must file a Tax Year 2021 return to claim the remainder of their CTC if any.

Payments begin July 15 and will be sent monthly through December 15 without any further action required. It provides information about the Child Tax Credit and the monthly advance payments made from July through December of 2021. The American Rescue Plan allowed 17-year-olds to qualify for the Child Tax Credit.

The letter says 2021 Total Advance Child Tax Credit AdvCTC Payments near the top and Letter 6419 on the bottom righthand side of the page. Decembers child tax credit is scheduled to hit bank accounts on Dec. ONE final advance child tax credit payment is coming in 2021 and the 300 payment is scheduled to reach families this week--just in time for the Christmas holidays.

It also provided monthly payments from July of 2021 to December of 2021. Beginning in July and running through December qualifying families can get up to. You can beneit from the.

Families will receive the entire 2021 Child Tax Credit that they are eligible for when they file in 2022. Many eligible taxpayers received monthly advance payments of half of their estimated 2021 Child Tax Credit amounts during 2021 from July through December. This includes families who.

For parents with children 6-17 the payment for December will be 250. Find out if they are eligible to receive the Child Tax Credit. 2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above.

This is a 2021 Child Tax Credit payment that may. The child tax credit was enhanced as part of President Joe Bidens American Rescue Plan signed into law in March 2021. Get the Child Tax Credit.

Enter your information on Schedule 8812 Form. The benefit amount assuming you received half the credit in 2021 from the. October 5 2022 Havent received your payment.

The credits scope has been expanded. Understand that the credit does not affect their federal benefits. Ontario trillium benefit OTB Includes Ontario energy and property tax credit OEPTC Northern Ontario energy credit NOEC and Ontario sales tax credit OSTC All payment.

Wait 10 working days from the payment date to contact us. The letters can help families determine how much. Get your advance payments total and number of qualifying children in your online account.

Claim the full Child Tax Credit on the 2021 tax return. The credit will be paid to families in 2021 and will be fully paid out in 2022. These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022.

300 a month per child for children ages 0 to 5. For the last six months of. After the December 15 payment eligible parents can also expect to see a big payday in 2022 when the other half of the child tax credit is issued to American parents during tax.

The IRS sent out the last monthly infusion of the expanded child tax credit Wednesday -- unless Congress acts to extend it for another year. The American Rescue Plan Act of March 2021 authorized the expanded Child Tax Credit. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17.

Between July and December 2021 as the pandemic and its dreadful effects on household incomes and budgets continued families with children under the age of 17 received advance CTC payments each. 15 and some will be for 1800. All payment dates.

To reconcile advance payments on your 2021 return. The Internal Revenue Service IRS disbursed these advance payments from July to December of 2021. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Previously only children 16 and younger qualified. The remaining 1800 will be. In December 2021 the IRS started sending letters to families who received advance Child Tax Credit payments.

For parents with children aged 5 and younger the Child Tax Credit for December will be 300 for each child.

Chelsea Cv Template In Blue Free To Download Cv Genius Cv Cover Letter Templates Cover Letter

Find The List Of All The Important Due Dates For Gst Compliance For The Month Of April 2021 Make Sure That You File Y Indirect Tax Billing Software Due Date

Pin By Portable Solar Llc Sol Ark On Sol Ark News Tax Credits Investing Solar Pergola

Rrsp Tfsa Oas Cpp Ccb Tax And Benefit Numbers For 2021 Tax Numbers Tax Return

H R Block 2018 Online Review The Best Option For Free File Hr Block Free Tax Filing Tax Refund

Adance Tax Payment Tax Payment Dating Chart

Dividend Growth Investor Dividend Aristocrats List For 2021 Dividend Aristocrat Stanley Black And Decker

The Truth Is Time Is Big Bucks Spend It Wisely Right Now You Should Be Busy Choosing A Tax Preparer T Small Business Growth Tax Preparation Tax Season

Usa Capital One Bank Statement Template In Word And Pdf Format Version 4 Statement Template Bank Statement Capital One

Itf 12c Pdf Expense Taxes Word Doc Taxact Self Assessment

Don T Delay Get Your Health Covered Today Health Plan Affordable Health Health

Daily Banking Awareness 14 And 15 May 2021 Awareness Banking Association Marketing

Banking Awareness Of 10 11 And 12 December 2021 Awareness Banking Indusind Bank

Tesla Tax Credit Coming To End On December 31st Act Fast To Save 1875 Tesla Tax Credits Cars Movie

The Truth Is Time Is Big Bucks Spend It Wisely Right Now You Should Be Busy Choosing A Tax Preparer T Small Business Growth Tax Preparation Tax Season

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

Daily Banking Awareness 20 21 And 22 December 2020 Awareness Banking Financial

Comments

Post a Comment